Bitcoin has inscriptions and will soon have runes, protocols for bitcoin-native

digital artifacts and tokens.

However, these assets still suffer from a lack of decentralized trading venues.

Assets on other chains are commonly traded using automatic market makers, or

AMMs. AMMs pool assets and use simple formulae to dynamically price swaps

between assets.

They are efficient from an on-chain transaction cost perspective, but they are

still on-chain, requiring additional transaction overhead compared to that

required for the swaps themselves.

They also produce inefficient prices, since AMM prices can only change as a

result of on-chain activities: deposits, withdrawals, and executions, which are

costly.

Bitcoin lacks the Turing-complete smart contracts necessary for implementing

AMMs. Fortunately, there is an alternative which is more efficient, both from a

transaction cost and pricing perspective.

The idea behind light pools is simple. Users who wish to offer swaps between

Bitcoin-native assets, like rare sats, inscriptions, or runes, run nodes which

quote prices for swaps.

These quotes are signed messages, gossiped between other light pool nodes.

Quotes must include

BIP-322

signatures of the UTXOs that contains the asset offered in trade. Requiring

signed quotes eliminates spam, since quotes can be rate-limited on a per-UTXO

basis. Additionally, when UTXOs are spent, corresponding offers can be dropped.

When a market taker wants to accept the quote of a market maker, they use the

information in the quote to construct a PSBT which includes their signatures,

and broadcast it to the network. These messages can also be gossiped by the

network, and rate-limited based on the taker's UTXOs. The maker receives this

message, possibly asyncronously, countersigns, and broadcasts it to the Bitcoin

network to be mined.

These PSBTs and transactions are not vulnerable to mempool sniping, since

signatures commit to all inputs and outputs.

Light pools require more implementation work than an AMM. Someone will need to

write an implementation of the gossip network, quote message format, and PSBT

construction and finalization. However, these are all done with a little bit of

elbow grease, and don't require tilting at the quixotic open-research-problem

windmills that plague much of cryptocurrency. (And Bitcoin, to be fair.)

The user experience of light pools should be quite good. Users can run their

own node to accumulate an order book, or rely on a third party. Prices can

update in real time, between blocks, without any on-chain activity.

Little work has been done on decentralized asset trading on Bitcoin, simply

because the market cap of Bitcoin-native assets was small. With rare sats,

inscriptions, and soon runes, the table is set and the time is ripe, and light

pools seem like a promising avenue to explore.

I've been working on a numbering scheme for satoshis that allows tracking and transferring individual sats. These numbers are called ordinals, and constitute a numeric namespace for Bitcoin. Satoshis are numbered in the order in which they're mined, and transferred from transaction inputs to transaction outputs in first-in-first-out order. More details are available in the BIP.

Ordinals don't require a separate token, another blockchain, or any changes to Bitcoin. They work right now.

Ordinals can be represented in a few ways:

With raw notation, like so 1905530482684727°. The number is the ordinal number, and the "°" is the Romance language ordinal symbol.

With decimal notation, like so 738848.482684727°. The first number is the block height, and the second is the index of the ordinal within the block.

With degree notation, like so 0°108848′992″482684727‴. We'll get to that in a moment.

A block explorer is available at ordinals.com. You can explore recent blocks, and look up ordinals by number, decimal, degree, or name.

Arbitrary assets, such as NFTs, security tokens, accounts, or stablecoins can be attached to Ordinals.

Ordinals is an open-source project, developed on GitHub. The project consists of a BIP describing the ordinal scheme, an index that communicates with a Bitcoin Core node to track the location of all ordinals, a wallet that allows making ordinal-aware transactions, a block explorer for interactive exploration of the blockchain, and functionality for minting ordinal NFTs.

Rarity

Since ordinals can be tracked and transferred, people will naturally want to collect them. Ordinal theorists can decide for themselves which sats are rare and desirable, but I wanted to provide some hints.

Bitcoin has periodic events, some frequent, some more uncommon, and these naturally lend themselves to a system of rarity. These periodic events are:

- Blocks: A new block is mined approximately every 10 minutes, from now until the end of time.

- Difficulty adjustments: Every 2016 blocks, or approximately every two weeks, the Bitcoin network responds to changes in hashrate by adjusting the difficulty target which blocks must meet in order to be accepted.

- Halvings: Every 210,000 blocks, or roughly every four years, the amount of new sats created in every block is cut in half.

- Cycles: Every six halvings, something magical happens: the halving and the difficulty adjustment coincide. This is called a conjunction, and the time period between conjunctions a cycle. A conjunction occurs roughly every 24 years. The first conjunction should happen some time in 2032.

This gives us the following rarity levels:

common: Any sat that is not the first sat of its blockuncommon: The first sat of each blockrare: The first sat of each difficulty adjustment periodepic: The first sat of each halving epochlegendary: The first sat of each cyclemythic: The first sat of the genesis block

Which brings us to degree notation, which unambiguously represents an ordinal in a way that makes rarity easy to see at a glance:

A°B′C″D‴

│ │ │ ╰─ Index of sat in the block

│ │ ╰─── Index of block in difficulty adjustment period

│ ╰───── Index of block in halving epoch

╰─────── Cycle, numbered starting from 0

Ordinal theorists often use the terms "hour", "minute", "second", and "third" for A, B, C, and D, respectively.

Now for some examples. This ordinal is common:

1°1′1″1‴

│ │ │ ╰─ Not first sat in block

│ │ ╰─── Not first block in difficutly adjustment period

│ ╰───── Not first block in halving epoch

╰─────── Second cycle

This ordinal is uncommon:

1°1′1″0‴

│ │ │ ╰─ First sat in block

│ │ ╰─── Not first block in difficutly adjustment period

│ ╰───── Not first block in halving epoch

╰─────── Second cycle

This ordinal is rare:

1°1′0″0‴

│ │ │ ╰─ First sat in block

│ │ ╰─── First block in difficulty adjustment period

│ ╰───── Not the first block in halving epoch

╰─────── Second cycle

This ordinal is epic:

1°0′1″0‴

│ │ │ ╰─ First sat in block

│ │ ╰─── Not first block in difficulty adjustment period

│ ╰───── First block in halving epoch

╰─────── Second cycle

This ordinal is legendary:

1°0′0″0‴

│ │ │ ╰─ First sat in block

│ │ ╰─── First block in difficulty adjustment period

│ ╰───── First block in halving epoch

╰─────── Second cycle

And this ordinal is mythic:

0°0′0″0‴

│ │ │ ╰─ First sat in block

│ │ ╰─── First block in difficulty adjustment period

│ ╰───── First block in halving epoch

╰─────── First cycle

If the block offset is zero, it may be omitted. This is the uncommon ordinal from above:

1°1′1″

│ │ ╰─ Not first block in difficutly adjustment period

│ ╰─── Not first block in halving epoch

╰───── Second cycle

Supply

Total Supply

common: 2.1 quadrillionuncommon: 6,929,999rare: 3437epic: 32legendary: 5mythic: 1

Current Supply

common: 1.9 quadrillionuncommon: 745,855rare: 369epic: 3legendary: 0mythic: 1

At the moment, even uncommon ordinals are quite rare. As of this writing, 745,855 uncommon ordinals have been mined - one per 25.6 bitcoin in circulation.

Names

Each ordinal has a name, consisting of the letters A through Z, that get shorter the larger the ordinal is. They could start short and get longer, but then all the good, short names would be trapped in the unspendable genesis block.

As an example, 1905530482684727°'s name is "iaiufjszmoba". The name of the last ordinal to be mined is "a". Every combination of 10 characters or less is out there, or will be out there, some day.

Exotics

Ordinals may be prized for reasons other than their name or rarity. This might be due to a quality of the number itself, like having an integer square or cube root. Or it might be due to a connection to a historical event, such as ordinals from block 477,120, the block in which SegWit activated, or ordinal 2099999997689999°, the last ordinal that will ever be mined.

Such ordinals are termed "exotic". Which ordinals are exotic and what makes them so is subjective. Ordinal theorists are are encouraged to seek out exotics based on criteria of their own devising.

Archaeology

A lively community of archaeologists devoted to cataloging and collecting early NFTs has sprung up. Here's a great summary of historical NFTs by Chainleft.

A commonly accepted cut-off for early NFTs is March 19th, 2018, the date the first ERC-721 contract, SU SQUARES, was deployed on Ethereum.

Whether or not ordinals are of interest to NFT archaeologists is an open question! In one sense, ordinals were created in early 2022, when I finalized the Ordinals specification. In this sense, they are not of historical interest.

In another sense though, ordinals were in fact created by Satoshi Nakamoto in 2009 when he mined the Bitcoin genesis block. In this sense, ordinals, and especially early ordinals, are certainly of historical interest.

I personally favor the latter view. This is not least because the ordinals were independently discovered on at least two separate occasions, long before the era of modern NFTs began.

On August 21st, 2012, Charlie Lee posted a proposal to add proof-of-stake to Bitcoin to the Bitocin Talk forum. This wasn't an asset scheme, but did use the ordinal algorithm, and was implemented but never deployed.

On October 8th, 2012, jl2012 posted a scheme to the the same forum which uses decimal notation and has all the important properties of ordinals. The scheme was discussed but never implemented.

These independent inventions of ordinals indicate in some way that ordinals were discovered, or rediscovered, and not invented. The ordinals are an inevitability of the mathematics of Bitcoin, stemming not from their modern documentation, but from their ancient genesis. They are the culmination of a sequence of events set in motion with the mining of the first block, so many years ago.

Crypto History

Prehistory

- Lots of interesting stuff here that nobody talks about

- Digital Monetary Trust: Private, anonymous, digital bank

- eGold

- Liberty Trust

2009 - Bitcoin

- Bitcoin launches and is the only cryptocurrency for a while

2011 - Early Altcoins

- Pure clones of bitcoin with a few parameters tweaked

- Changed supply, difficulty adjustment, PoW algorithm

- Big lesson was that Bitcoin gets all these things mostly right, no strong advantage to changing them

- A few projects tried to do something different and interesting, e.g., namecoin

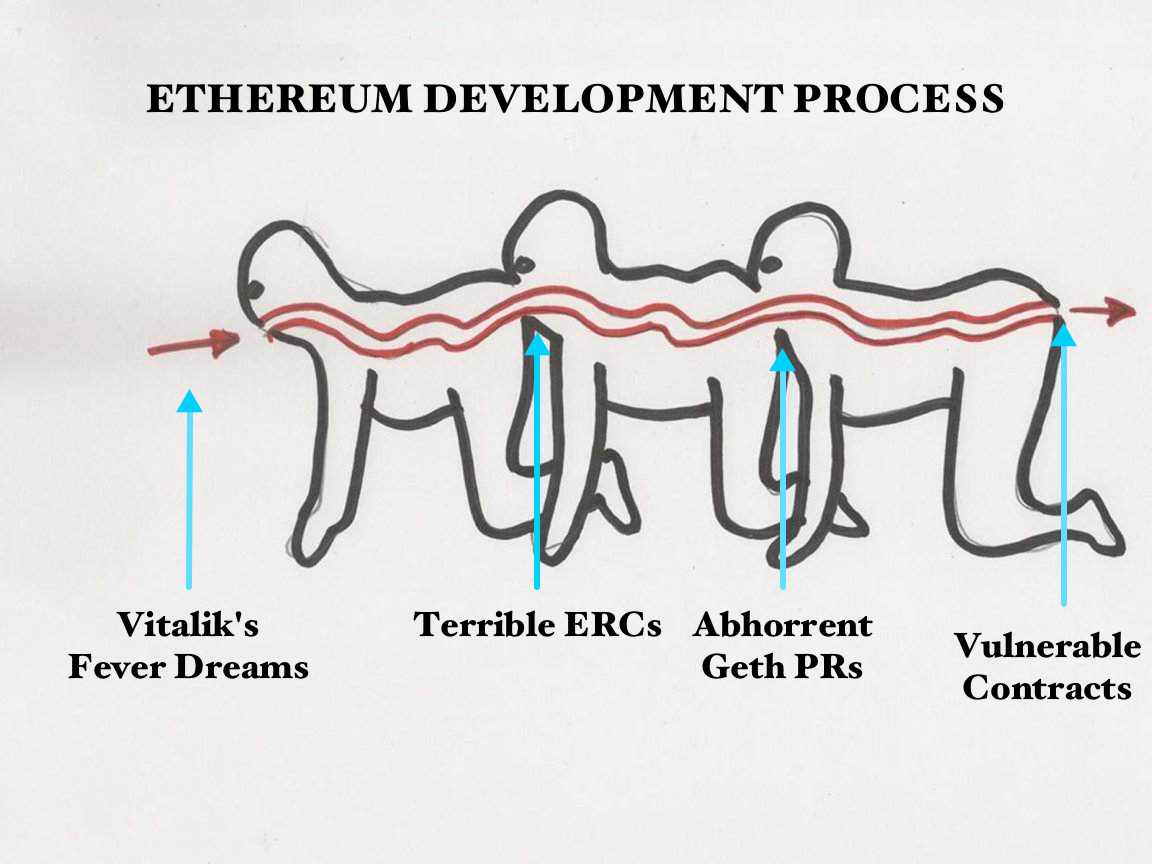

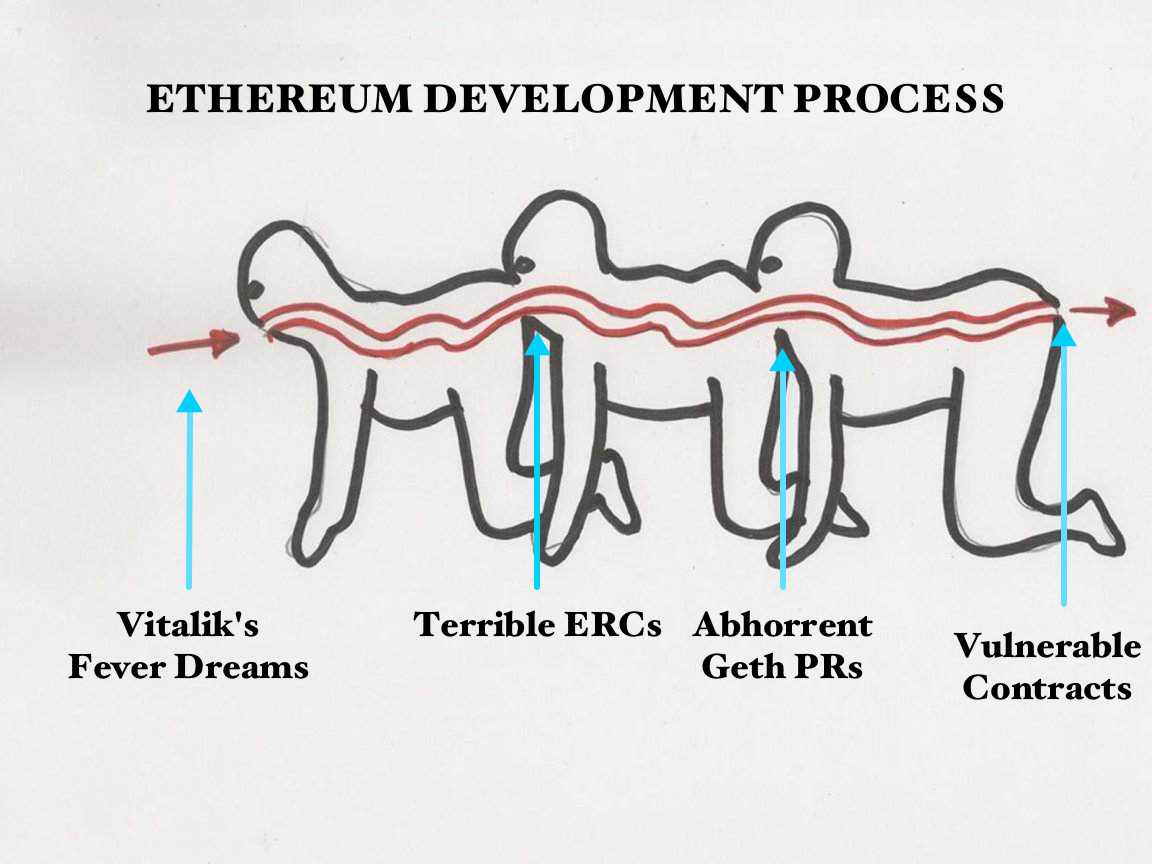

- I would actually include Ethereum in this latter category, however Ethereum has problems

2017 - ICO Boom

- In the early altcoin period, launching a coin was relatively hard, because you had to deploy software to computer and get other people to run it

- With Ethereum, you could just write an ERC20 contract and deploy it to Ethereum, so technical bar was very low

- Ethereum normalized tokens, premines, and presales, so community couldn't fundamentally reject zero-value cash grabs

2020 - DeFi and NFTs

- DeFi is basically repackaging of ponzi scheme economics

- Huge NFT bubble as people overestimate what NFTs can do and what they'll become

Crypto Psychological Archetypes

- Grifters: Incentivized to lie, hype, and overestimate what their projects can do

- Astronauts: Underestimate technical complexity, assume all problems can be solved

- Vitalik is an astronaut par excellence. People in this group underestimate need for security, simplicity, aligned incentives

- Probably enthusiastic about complex large-scale social and economic interventions. Remind me of fringe political and economic theorists

- Worst example is economic space agency

- The hoi polloi:

- Unit bias (Bitcoin is too expensive!)

- FOMB: fear that they missed the boat with bitcoin, must find new boat no matter how shitty

- Zero technical understanding, ingest radical bullshit from grifters and astronauts alike

- Think bitcoin is a prototype. No, bitcoin is like the internet, has problems but better to just deal with them

What's wrong with…?

Ethereum

- Solidity has terrible semantics

- Terrible and insecure code, even in major projects, nobody actually audits contracts

- Scaling comedy: State channels, plasma, plasma cash, sharding, roll ups. No good scaling story. Everything they're pursuing comes with massive costs.

- Massive premime. Fine during PoW, leads to massive centralization post PoS transition

- Security comedy: Solidity is phenomenally bad, everything big gets hacked, see rekt.news

- Optimism has no fraud proofs yet has $X TVL

- Community tolerates tokenization, so everything gets tokenized. Their lighting competitor got tokenized. This is serious karmic rot that infects everything.

DeFi

- Almost all ponzi economics

- No value creation

- No underlying economic activity, all finance

- Can't create credit, can only do collateralized lending, so can't serve most useful credit creation function

- Insanely complex and insecure

Stable Coins

- Actually often pretty high utility. People who want digital dollars can't access them

- Algorithmic stablecoins are doomed

- Best case scenario is digital, private, fully-collateralized bank on crypto rails

Solana

- Wildly centralized

- Insanely complex

- Terrible incentives: Couldn't resist big blockers in same way bitcoin did

- Insane costs to running a full node

NFTs

- Most contracts are fully centralized

- Contents are fully centralized, just point to some server somewhere

- Nobody audits, so each is a special snowflake complexity

- Massive overestimate of how useful NFTs are or what they'll become

- Nothing actually wrong with making digital baubles and selling them

Cardano

- Had a plane ride next to highly technical Cardano guy, very nice, very smart

- Fully just following incentives

- Technicals are terrible

Proof of Stake

- Stake ratchet: Strong centralization pressure

- Merges token holders and miners, in bitcoin these are separate groups who keep each other in check

Monero

- Relatively non-awful. Fair launch, community driven.

- Hard forks mean developers have a lot of power

- Has on-chain privacy, but transactions are 8x larger than bitcoin, so 1/8 transaction throughput

- Lighting is the way for privacy. Use lightning network to mix your coins. Make big channel with tainted coins, pay someone for inbound liquidity w/lightning, slosh your coins over to channel w/inbound liquidity, close back to BTC.

Grin

- Fair launch privacy coin with interesting tech

- Absolutely dead in the water because no VC marketing budget

zcash

- Centralized, blocks just give money to core devs.

- Moon math led to inflation bug. Probably not exploited, but no way to know.

Urbit

- Urbit's okay

- Some technical problems that make me worried

- Noble effort to decentralize social media

A large reputable member threshold multisig operating as functionaries for a Bitcoin-pegged deterministic replicated state machine sidechain with as-compatible-as-possible-with-mainchain semantics is probably more reliable and secure that most alternative chains.

-

Large: The number of functionaries should be large enough to ensure geographic, jurisdictional, and administrative distribution.

-

Reputable members: Functionaries should be chosen who would suffer a reputational loss in the case of poor performance.

-

Threshold multisig: A M-of-N multisig. M should be at least ⌊N/2+1⌋, to reduce the chance of equivocation.

-

Deterministic, functionaries: Discretion is unpredictable and morally hazardous. The semantics enforced by the functionaries should be deterministic and predictable, not discretionary. Semantics should never change, and if they must, changes should be announced long enough in advance to make exit practical.

-

Bitcoin-pegged: If the currency of the sidechain isn't bitcoin, users of the sidechain cannot meaningfully exit. Ability to exit incentives the functionaries to be good stewards of the sidechain.

-

Replicated state machine: The state of all functionaries should be the same, and it should be able to recreate and run ones own copy of the state machine.

-

Sidechain: Functionaries should publish a sequence of block headers where each block header includes the hash of the current state, as well as the hash of the previous state. Previous states should also be made available by functionaries, in order to make the system auditable.

-

As-compatible-as-possible-with-mainchain semantics: The ability of users to exit should be maximized, and making the semantics of the sidechain as close as possible to those of the mainchain maximizes the ability to exit, by allowing users to destroy atomically destroy assets on the sidechain in exchange for mainchain assets which mimic the properties of the atomically destroyed assets.

-

Probably more reliable and secure than most alternative chains: Alternative chains suffer from many issues. Proof-of-work suffer from a large global pool of potential hashrate that can attack. Proof-of-stake chains suffer from byzantine consensus mechanisms of ever increasing complexity which must operate in a fully adversarial environment, and have economics which allow and incentivize centralization. A multisig chain operates with a far simpler and more understandable security model: the functionaries periodically agree on a new set of transactions, run the transactions on the old state to produce the new state, and sign and publish the result. Such a system should be more reliable, predictable, and secure.

And not only that, if the functionaries are chosen carefully, such that there is a huge number of them, perhaps greater than 50, and they are all reputable entities, they should be both incentivized to run the chain properly, and with limited latitude for malicious behavior.

There are a lot of things that I wish would happen, but don't have the time to

actually do myself. I complain about such things all the time to basically

anyone who will listen. Such efforts are all well and good, and sometimes

actually pay off, but additionally, I'd like to materially support people who

might actually do these things.

This post, which I'll try to keep up-to-date, if I remember, documents the

projects which I wish some talented go-getter would take on, and in which I

would invest money in if given the opportunity.

If you are one of these aforementioned go-getters,

email me!

-

Email-based messaging: The only reason we use anything but email to

communicate is because email is missing features that could easily be added.

Deliver us from multi-messaging app hell!

-

RSS-based social networking: RSS could easily serve as the basis for

standards-based social networking, and would be useful even without taking a

significant market share.

-

Bitcoin-based NFTs: NFTs are getting lots of creative people both excited and

paid. Let them suckle at mama Bitcoin's sweet and bountiful bosem instead of

Ethereum's shrivled, insecure, bitter, centralized tit. This can't be done on

the Bitcoin L1, so should be pursued as an L2. The key here is figuring out

how to avoid needing a new token.

-

Bitcoin-based smart contracts: Much like the NFT item above. Let the degens

feast at the Bitcoin board, not at the Ethereum kiddy table. Must avoid

needing a new token. The best path forward is to fork Liquid, add smart

contract functionality to Elements, and run it as Bitcoin-pegged federation.

-

Self-hosted block game: There should be a Minecraft-like game that can be

programmed and modded from within the game.

Good evening list,

This mail is inspired by Chia's coin IDs. Chia coin IDs consist of:

sha256(parent id, sha256(scriptpubkey), amount)

One consequence of this is that outputs in Chia have a dedicated textual ID.

This seems beneficial, separate from any larger technical consequences, and

made me wonder if we couldn't replicate that in Bitcoin.

Outputs, a.k.a. outpoints, are commonly represented as TXID:INDEX. For

example, the first output of transaction

c7dd35a4f81977feac0d235d0e77265cacd362bfc2f0246e384a80d3b0a53a9b is represented

as c7dd35a4f81977feac0d235d0e77265cacd362bfc2f0246e384a80d3b0a53a9b:0.

I find this representation unsatisfying:

- It places outpoints hierarchically beneath transactions, even

though after a transaction is confirmed, the outpoint is relatively

independent.

- It can't be double-clicked to be easily copied.

- It isn't popular or widely used. I tried using it in searches in a few block

explorers[0], and none of them support it, even though they do support direct

searches by transaction ID, block hash, and block height.

I propose a dedicated representation of outputs using Bech32m. Bech32m is

especially legible, due to its human-readable part, and is compact, and easy to

type and verify. Although having error correction doesn't seem absolutely

necessary, it doesn't seem like a downside. The representation uses "coin" as

the human-readable part, with the payload being the transaction ID, followed by

the 4 byte index.

For example:

c7dd35a4f81977feac0d235d0e77265cacd362bfc2f0246e384a80d3b0a53a9b:A0

Becomes:

coin1clwntf8cr9mlatqdydwsuaextjkdxc4lctczgm3cf2qd8v9982dsqqqqqqqenjt7

Anacdotally, I find that many non-expert users I talk to think and talk about

Bitcoin as if it were an account-based system, and tend to think in terms of

transactions. I wonder if having coin IDs, in the form I propose or in some

other form, would help remedy this, similar to how transaction ids, block

hashes, and addresses help reify those concepts. The particulars of the

representation are of secondary importance.

Best regards,

Casey Rodarmor

[0] blockstream.info, blockchain.com, mempool.space, blockcypher.com, and

blockchair.com

Federated blind mints have attractive privacy, scaling, and security properties

that are highly complementary to those of Bitcoin and the Lightning Network.

I originally became interested in blind mints while thinking about Lightning

Network wallet usability issues. When Lightning works, it is fantastic, but

keeping a node running and managing a wallet present a number of challenges,

such as channel unavailability due to force closes, the unpredictability of the

on-chain fee environment, the complexity of channel backup, and the involved

and often subtle need to manage liquidity.

All of these problems are tractable for a skilled node operator, but may not

be soluble in the context of self-hosted wallets operated by non-technical

users, hereafter normies. If this is the case, then normies may have no

choice but to use hosted Lightning wallets, compromising their privacy and

exposing them to custodial risk.

Chaumian mints, also known as Chaumian banks, or blind mints, offer a

compelling solution to these problems, particularly when operation is

federated. Chaumian mints, through the use of blind

signatures, have extremely

appealing privacy properties. The mint operators do not know the number of

users, their identities, account balances, or transaction histories.

Additionally, mint transactions are cheap and can be performed at unlimited

scale.

Mint implementations, typified by eCash,

have hitherto been centralized, and thus, like all centralized, custodial

services, expose users to custodial risk in the form of operator absquatulation

and mismanagement. To fix this, mint operation can be federated, with all

operations performed by a quorum of nodes controlled by different parties.

Despite these interesting properties, Chaumian mints have largely been

forgotten. This post gives an

excellent overview of the phenomenon. I believe that Chaumian mints are

currently severely underrated in general, and in particular deserve

consideration as a potential avenue for improving custodial Lightning Network

wallets.

Compared to a naïve hosted Lightning Network wallet, a service operated as a

federated Chaumian mint offers excellent privacy, usability, security, and

scaling.

Privacy: Privacy leaks from a Lightning mint come in two forms, internal

and external, when a mint operator or an outside actor, respectively,

observes sensitive information.

Blind signatures protect against internal privacy leaks, making them a strict

improvement in that respect over custodial Lightning wallets.

When compared to a single-user Lightning network wallet, Lightning mints also

protect against external privacy leaks. If the activity of a single-user

Lightning Network wallet can be observed, which is possible but non-trivial,

all such activity is preemptively that of the owner of the wallet. However,

similar to a standard custodial Lightning Network wallet, any observable

Lightning Network activity of a Lightning mint is the aggregate activity of its

users, who thus form an anonymity set. If the number of users, and thus the

anonymity set size, is large, external privacy leaks are also prevented.

Usability: Compared to a self-managed Lightning Network wallet, and similar

to a standard custodial Lightning Network wallet, Lightning mint wallets offer

superior usability. A user need not be concerned with the details of node

operation or channel management, and can deposit to and withdraw from their

account with standard Lightning Network invoices.

Security: The security of a Lightning mint is weaker than that of a

self-hosted wallet. A quorum of federation members can abscond with funds.

However, compared to a standard custodial Lightning Network wallet, security is

greatly improved. Additionally, federation members might be located in

different jurisdictions, making the mint robust to regulatory interference.

Furthermore, members might be entities with online reputations, such as

anonymous Bitcoin Twitter users with an established history of productive

shitposting, providing further assurances against mismanagement and fraud.

Scaling: Mint operations are extremely lightweight, similar to Lightning

Network transactions, so scaling properties are similar to the Lightning

Network itself. Additionally, users need not manage their own channels, so a

well-capitalized federation can open channels efficiently, lowering the

per-transaction channel management overhead.

Interoperability and market dynamics: Additionally, my hope is that such

systems will be developed with a standardized protocol for communication

between wallet interfaces and mint backends. This would allow users to use

different backends with the same local wallet interface, encouraging

competition in the market.

For more discussion of Chaumian mints and their applicability to Bitcoin, see

fedimint.org. Elsirion, the author, is also at work on

MiniMint, a federated Chaumian mint with Bitcoin and eventually Lightning

Network support.

To close with a bit of speculation, I believe that Chaumian mints were never of

particular interest or importance because they were limited to interoperating

with the fiat currencies of the time. With the ascendance of Bitcoin, mints now

have access to a powerful, decentralized, and uncensorable currency , made

economical and fast by the Lightning Network.

I believe this layering of Chaumian mints on top of Bitcoin and the Lightning

Network will, in the fullness of time, be demonstrated to be enormously

powerful, and make Chaumian mints themselves worthy of renewed study and

consideration.

Bitcoin will greatly reduce the power of the state, which rests entirely on its capacity for violence. This capacity is maintained by paying and equipping people to commit violence on its behalf, and it acquires the resources to do so by printing money, collecting taxes, and issuing debt.

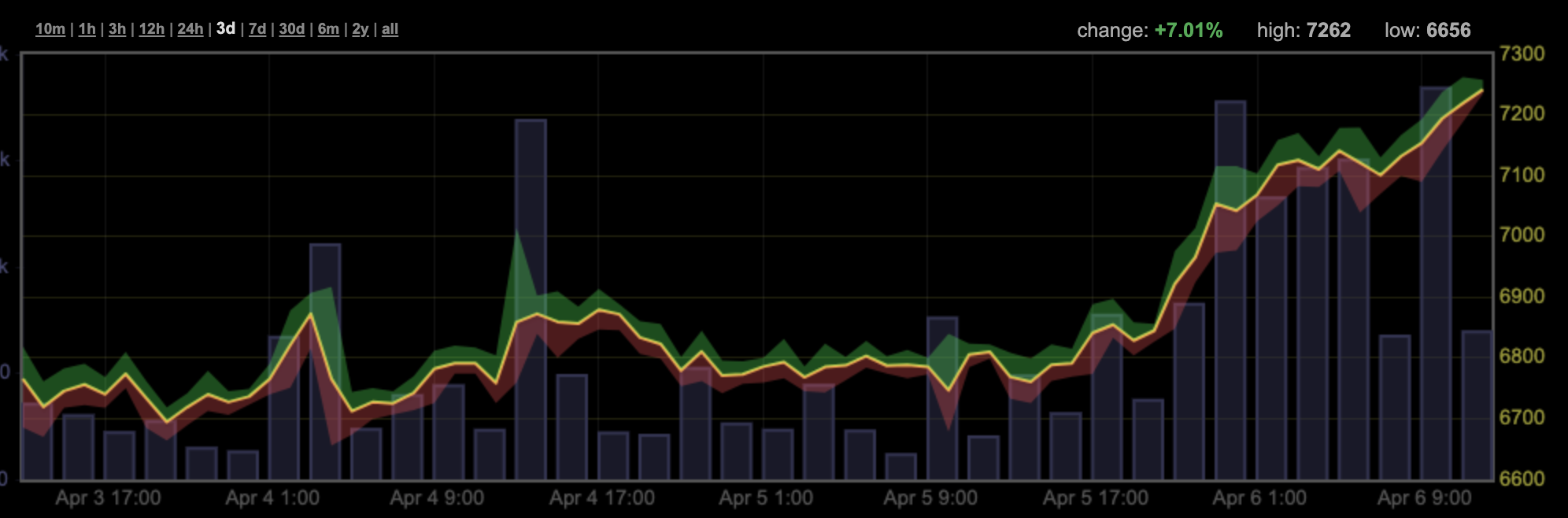

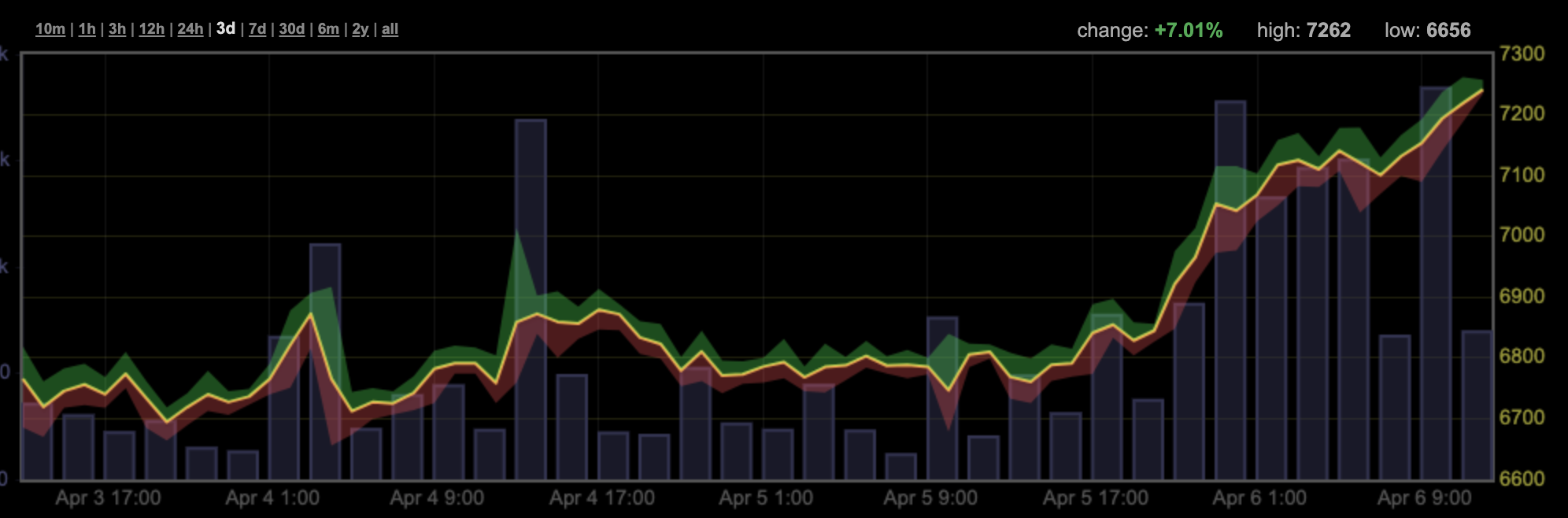

BTC chart lookin' spicy 👀👀👀

A Kademlia-inspired modification of Dandelion for use in Grin.

We all stood, gathered our things, walked down the cafe stairs and out to the dark and bustling Berlin street.

After a few goodbyes and handshakes, everyone headed off in different directions, for different destinations.

The meeting had felt momentous to me, a marker of strange and interesting times to come. I headed to the U-Bahn, alone.

Lighting Network payment channels could be established between users and exchanges to speed the transfer of funds.

This would be a huge boon, moving many on-chain deposit and withdrawal transactions off-chain, but is possibly only the beginning.

Since Lightning Network payments can span different blockchains, an exchange could use a cross-chain Lightning node to expose its internal order book to external entities.

IOTA is a cryptocurrency targeting the internet of things. It purports to be scalable, decentralized, and feeless. Unfortunately it is none of those things.

In this article I attempt to summarize the numerous technical, social, and ethical problems surrounding the IOTA project, The IOTA Foundation, and the IOTA developers.

Investing in cryptocurrencies is not the same as buying simple equity in a company.

Although each company has a different business model, they and the equity they issue are largely structurally homogeneous. They hold their monies in banks, pay for their expenses with wire transfers and cheques, follow prescribed rules of accounting, and issue stock that operates according to well understood rules. This is not to say that said practices are good or bad. They are simply a known factor.

Cryptocurrencies and tokens, however, are structurally heterogeneous. They have different codebases, modes of operation, levels of complexity, and security models. Although broadly lumped into the same category, they can, by the nature of these differences, have almost nothing in common.

Investing in one is like buying stock in a company with novel business models, banking practices, and accounting methods, and furthermore whose stock is issued under a bespoke scheme and follows unique trading rules.

Accordingly, a much, much greater level of care is required when making such investments. If any one of these novel mechanisms fail, your investment may go up in billowing smoke and flames overnight.

This is not to say that you should completely avoid cryptocurrencies and tokens, just, you know, do your homework.